General liability insurance is often the first commercial policy a small business buys, and for good reason. If a customer slips in your shop, you’re accused of damaging a client’s property while working on site, or a marketing claim triggers an “advertising injury” allegation, the legal defense alone can be financially disruptive, even when you did nothing wrong. General liability is designed to step into that gap.

Below is a practical, plain-English breakdown of general liability insurance for small businesses, including what it covers, what it does not, how limits work, and how to choose coverage that matches the contracts and real-world risks you face.

What general liability insurance is (and what it is not)

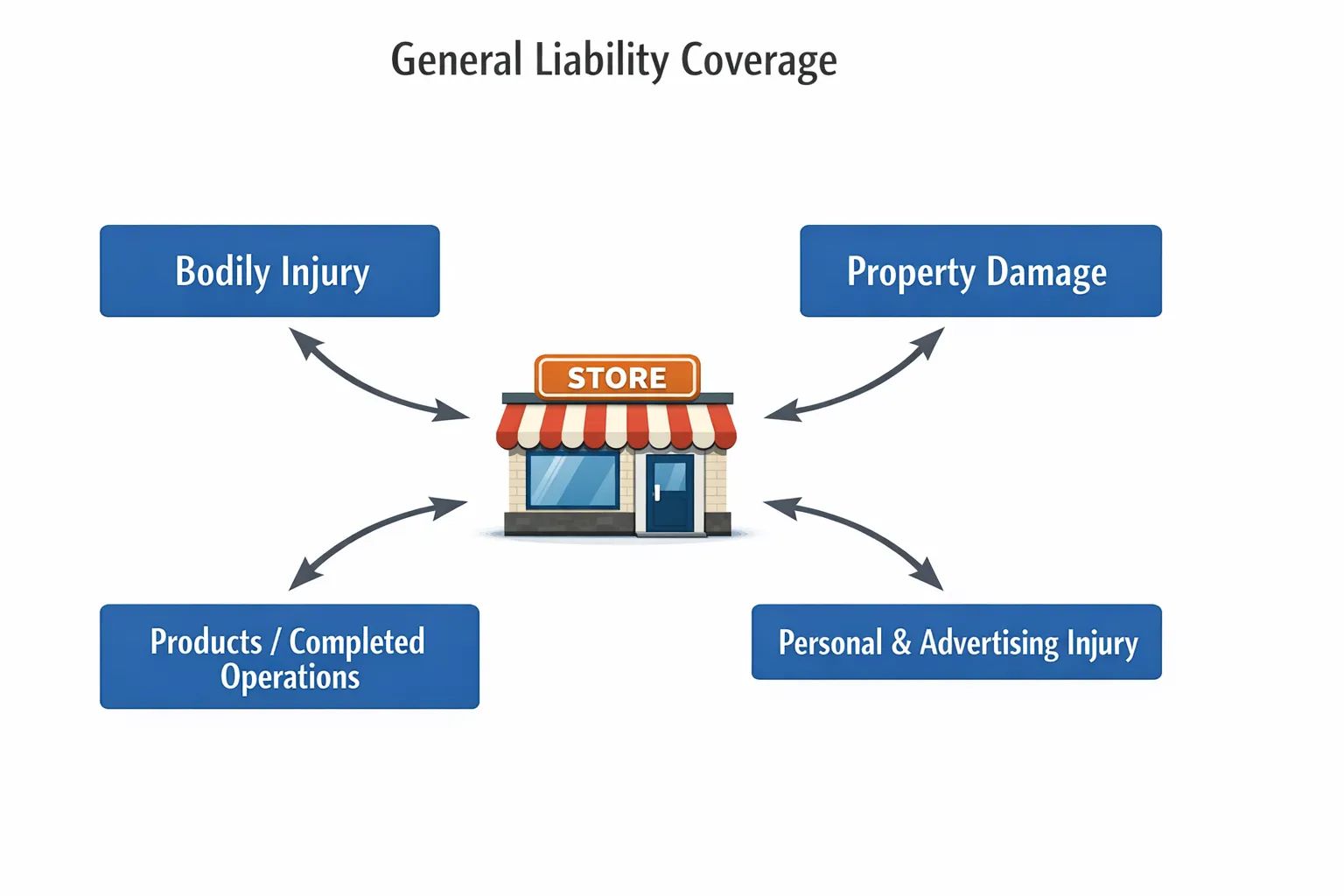

General liability (GL) is a foundational business insurance policy that primarily addresses:

- Third-party bodily injury (someone gets hurt and your business is alleged to be responsible)

- Third-party property damage (you damage someone else’s property)

- Certain personal and advertising injury claims (for example, libel/slander allegations tied to your advertising)

- Related legal defense costs for covered claims

A key point: GL is about harm to others, not damage to your own business property, and not injuries to your employees. Those are typically addressed by commercial property insurance and workers’ compensation.

Many GL policies in the U.S. are built on standardized policy language (often based on ISO forms, depending on the carrier). If you want to see how the industry commonly structures Commercial General Liability coverage, the Insurance Services Office (ISO) is a helpful reference point.

What general liability insurance typically covers

Coverage details vary by carrier and endorsements, but a small business GL policy commonly responds to claims in these buckets.

1) Bodily injury claims (third-party)

This is the classic “slip and fall” scenario, but it can also include allegations like:

- A visitor trips over a cord in your office

- A customer is injured by a falling display

- A client is injured at a jobsite where you’re performing work

GL can help pay for covered medical costs, legal defense, and settlements or judgments (up to the policy limit).

2) Property damage to others

Examples include:

- A contractor accidentally breaks a homeowner’s countertop during installation

- A cleaning company damages a client’s flooring with the wrong chemical

- A vendor’s equipment causes damage at a venue

3) Products and completed operations

If you sell products, manufacture items, or install/repair things, products-completed operations is the part of GL that can respond to allegations that a product defect or completed work caused injury or property damage.

This is especially relevant for trades, installers, specialty contractors, and certain e-commerce brands.

4) Personal and advertising injury

This coverage is commonly misunderstood. It is not “marketing insurance.” It generally relates to specific alleged offenses such as libel, slander, or certain copyright and trade dress issues in advertisements (exact triggers depend on policy wording and exclusions).

For a small business running ads, managing a website, or competing in a crowded local market, this can matter more than you’d think.

What general liability insurance usually does not cover

This is where many unpleasant surprises happen. GL is broad, but it is not unlimited.

Here’s a quick comparison table of common inclusions and exclusions to help you sanity-check your expectations.

| Scenario | Usually covered by general liability? | Notes |

|---|---|---|

| Customer slips and is injured at your location | Often yes | Subject to negligence allegations, defenses, and policy terms |

| You accidentally damage a client’s property while working | Often yes | Depends on specifics, exclusions, and whether it’s “your work” or “your product” related |

| Employee gets hurt on the job | No | Usually workers’ compensation |

| Damage to your own building, tools, or inventory | No | Usually commercial property or inland marine |

| Professional mistake or bad advice (design error, incorrect recommendation) | Usually no | Often requires professional liability (E&O) |

| Auto accident while driving for work | No | Usually commercial auto (or hired/non-owned auto coverage endorsement) |

| Cyber incident, data breach, ransomware | No | Usually cyber liability |

| Intentional wrongdoing | No | Insurance generally does not cover intentional harm |

For a neutral overview of how business liability insurance works and why different policies exist, the Insurance Information Institute has helpful consumer-focused explanations.

Who needs general liability insurance (real-world triggers)

Even very small operations often run into GL requirements because other people, landlords, and larger customers are trying to manage their own risk.

Common situations where GL is requested:

- Commercial leases: landlords frequently require GL (and often specific limits) before handing over keys.

- Client contracts: especially for contractors, consultants doing on-site work, event vendors, and service providers.

- Vendor onboarding: many companies require a certificate of insurance (COI) to add you to an approved vendor list.

- Loan or investor requests: less common than leases/contracts, but it happens.

Even if nobody requires it, the decision often comes down to a simple question: Could one allegation from a third party create a defense-cost problem you’d rather transfer to an insurer?

Understanding policy limits and common add-ons

Small business owners typically see GL policies described with a few standard terms. Your agent can explain what your carrier uses, but these are common categories.

| Term you’ll see | What it generally means | Why it matters |

|---|---|---|

| Per occurrence limit | Max the policy pays for a single covered incident | Contract requirements often reference this |

| General aggregate limit | Max the policy pays for covered claims during the policy period | Multiple claims can erode this |

| Products-completed operations aggregate | Separate aggregate for products/completed work claims | Important for contractors, installers, product-based businesses |

| Medical payments | Smaller no-fault medical payments for minor injuries | Can help resolve small incidents quickly (varies by policy) |

Additional insureds (a common contract requirement)

Many contracts require you to name a client, landlord, or upstream contractor as an additional insured. This is not just paperwork. It changes how coverage may apply for that other party in connection with your operations.

If you sign contracts that require additional insured status, it’s worth reviewing the exact language and making sure your policy endorsements match what you agreed to.

General liability vs. a Business Owner’s Policy (BOP)

A BOP often bundles general liability with commercial property coverage (and sometimes business income coverage) for eligible small businesses.

If you’re comparing GL-only versus a BOP, the right question is not “which is cheaper,” it’s “which covers the biggest financial stress points for how we operate.”

What determines the cost of general liability insurance for a small business?

Pricing is carrier-specific, but underwriters generally look at a mix of:

- Industry and operations: a clerical consulting firm and a roofing contractor present very different injury/property damage exposures.

- Revenue and payroll: often used as exposure bases, depending on class codes and carrier approach.

- Claims history: frequency and severity trends matter.

- Location and jobsite exposure: where you work and how often you are on third-party premises.

- Subcontractor use: whether you use subs, and whether you collect certificates of insurance.

- Contracts: risk transfer terms (indemnification, additional insured requirements) can affect underwriting comfort.

A practical takeaway: if your business is growing, adding new services, expanding territory, or taking on larger contracts, it’s smart to treat GL as a living part of your risk plan, not a once-a-year renewal task.

Claims examples: how general liability plays out

The best way to understand GL is to map it to situations small businesses actually face.

| Business type | Example allegation | Where GL may respond |

|---|---|---|

| Retail store | Customer slips near entrance on a rainy day | Bodily injury, legal defense |

| Janitorial service | Floor finish damages client’s flooring | Property damage, legal defense |

| Handyman/contractor | Completed repair fails and causes water damage | Products-completed operations (subject to terms/exclusions) |

| Marketing agency | Competitor alleges a campaign includes defamatory statements | Personal and advertising injury (subject to terms/exclusions) |

Important nuance: a claim can be filed even when you believe you did nothing wrong. One of the most valuable parts of GL coverage is often the defense function, depending on how the policy is written.

Common mistakes small business owners make with general liability

Assuming “general liability covers everything”

It does not. The most common gaps we see small businesses overlook are professional liability (E&O), cyber, and auto-related exposures.

Buying limits based only on price, not on contracts

If your lease or customer contract requires specific limits, you can end up scrambling after the fact, or worse, in breach of contract.

Not tracking certificates of insurance for subcontractors

If a sub causes damage and they are uninsured (or underinsured), the claim often finds its way back upstream. Collecting and reviewing COIs is a basic risk-control habit that supports your insurance program.

Forgetting to update the insurer when operations change

Adding new services, selling new products, changing how you deliver work, or expanding into new states can affect eligibility, rating, and coverage triggers.

How to choose the right general liability policy for your small business

A good buying process is less about guessing and more about translating your operations into underwriting language.

Start with your risk map and your contracts

Bring these to the conversation:

- Your lease insurance requirements (if applicable)

- Customer and vendor contract requirements

- A quick description of your services, where you perform them, and who you perform them for

- Whether you use subcontractors, and how you manage risk transfer

Ask focused coverage questions

Rather than asking “Am I covered,” ask questions tied to your workflow, for example:

- “We do work on customer premises weekly, what exclusions or endorsements should we watch?”

- “We install products, how is products-completed operations handled and what impacts it?”

- “We sign contracts requiring additional insured status, which endorsement form applies?”

Coordinate GL with the rest of your program

General liability is usually one piece of a broader stack that may include:

- Workers’ compensation

- Commercial auto (or hired and non-owned auto)

- Professional liability (E&O)

- Cyber liability

- Umbrella or excess liability

That coordination is where many small businesses either build resilience or accidentally create gaps.

A Georgia note: why local guidance can matter

Policy language is often standardized, but your real exposure is local. In Georgia, many small businesses encounter fast-moving requirements tied to growth, new construction, subcontractor use, and contract-driven insurance terms.

If you want a Georgia-specific overview of commercial coverage options beyond GL, Zorn Insight also has a local guide worth reading: Business Insurance in Vidalia, GA | Commercial Coverage for Local Companies.

When it makes sense to talk to a risk advisor (not just “get a quote”)

If you are simply fulfilling a landlord requirement, a quick GL quote might be enough. But many small businesses hit a point where insurance decisions start affecting operations and profitability.

Consider a deeper review if:

- You are signing larger contracts with insurance requirements you do not fully understand

- You use subcontractors regularly

- You have recurring on-site exposure at customer locations

- You are adding new services or selling new products

- You have had a near-miss incident, demand letter, or claim in the past year

Zorn is a boutique insurance and risk management firm based in Georgia. If you want help translating your day-to-day operations, contracts, payroll realities, and HR practices into a practical insurance program, you can start a conversation here: Zorn Insight.

General liability insurance for small businesses is not about checking a box. It’s about making sure one unexpected allegation does not become a distraction that drains time, cash, and momentum when you are trying to run and grow the business.